The star of the sports supplement market, but is the influential advertising and branding of these protein products pushing the boundaries?

Rummage through any training rucksack in the 80s and the likelihood is you would have unearthed a hefty-looking flask with an interesting scent. The sight of inflated folk with river map veins guzzling down viscous potions among the iron and chains was all too familiar, but these days it isn’t just bodybuilders with tiny shorts who have their precious protein shakers glued to their hand.

With health and fitness at the forefront of modern trends to follow, it’s noticeable that these shakes are now a fundamental icon of training and consuming them is perceived as a key element when pursuing a healthy lifestyle. However, it’s often questionable what these concoctions consist of, and when ex-Mr Olympia and Terminator Arnold Schwarzenegger declared he would tend to dash multiple glugs of whiskey into his protein shake, you can see why.

Sitting at the pinnacle of the sports supplement market, whey protein powders have been modified and developed extensively over the last few decades and are continually growing in strength. The rise of the whey protein market has intensified in recent years as the fitness and nutrition industry has grown into an expendable economy and is rapidly being viewed as one of the powerhouses of world trade.

But what’s the big hype? Protein; one of the primary macronutrients used by the body to maintain normal function and recover from physical demand, is essential for recovery of muscle breakdown and regeneration of tissues. Protein is also used to make enzymes, hormones and other chemicals in the body. In fact, every cell in the body uses protein in some kind of way. It’s obvious why protein, sourced from foods, is an essential part of a balanced diet.

With its efficiency and effectiveness, it’s also obvious why the macronutrient was identified as an invaluable way to speed up recovery if it could be extracted from a food source and formed into a supplement. The breakthrough? Separating the by-products of fermented milk meant protein could be extracted and developed into a dried and concentrated whey powder. Gulping it down as a drink straight after finishing a workout has long been regarding as beneficial, providing an efficient delivery of fast-release proteins and amino acids to aid recovery.

Combine the evidence with the latest trend of being muscular while having low levels of body fat and you can see why the products have grown enormously in popularity. An area that seems to have peaked recently as an aspirational trend is fat loss; or cutting, shredding, toning as some may call it. High protein and low carbohydrate dieting is a popular strategy when ‘shedding fat’, which in bodybuilding and sporting terms is proven and effective, but has seemed to correlate into mass use of protein based products, sometimes instead of whole foods in an unbalanced diet. The desire for the body to enter ketosis (burning fat as fuel instead of glycogen from carbohydrates) on a high protein diet has partly influenced the consumption of protein powders due to their simplicity, effectiveness and attraction.

Meanwhile, the proof that protein supplements can help muscles recover faster and more efficiently means more training can be carried out. More training means further muscle breakdown and recovery, or ‘gains’ as some may say. The current necessity for ‘gains’ is another social trend that sits alongside its fat-loss sidekick in terms of exercising and lifestyle. With these two reasons established and clearly being attractive, when and why is it time to start using these protein supplements? “I first bought it when I was about 17, I just wanted a bit of better performance and better recovery after the gym” said one budding trainer from The Engine Room gym in Plymouth.

Although each have their own reasons for using whey protein as a supplement and why they first purchased it, there is a noticeable trend from these young and budding trainers at a side-street gym in the heart of Plymouth, Devon. Efficiency, effectiveness and performance; the foundations of their reasoning for combining the supplement with their training. Whether these reasons are partly influenced by peers, science or other factors remains specific to the individual but a more mainstream factor cannot be ignored: the influential marketing, branding and advertising strategies of the companies behind the products.

Muscle Motives

Developments in both processing and selling methods, combined with social commerce and internet advertising has seen the industry multiply extravagantly in worth and supply in the 21st century alone. As technology and science open more doors, the sports supplement brands within the industry continue the ongoing battle of developing and advancing their innovative products, and it seems everyone wants a slice of the action. In April last year, soft drink giants Coca-Cola decided to get involved and bought a line of Chinese drinks made from plant-based proteins for around $400m.

The turning point for the industry? A change in our perceptions began to take place when around a decade ago MaxiMuscle, a leading protein supplier now known as MaxiNutrition, decided to branch out from bodybuilding and go a little more mainstream. The company started advertising in magazines and online, using everyday ‘fitness models’ rather than competition ready Schwarzenegger-like physiques. It wasn’t long before the competitors started to play catch-up and also branch out into different areas. As the industry grew, so did the amount of people behind the products. “This is something that as the industry has grown we are seeing more supplement companies recruit athletes, nutritionists etc. who have knowledge to help back up the products with information on how to use them,” says Tom Hamilton.

With science at the core and the need being defined, it wasn’t long before vast amounts of suppliers and companies sprouted around the world. The UK in particular played host to several innovative product launches and marketing schemes for companies and their new lines. Fast forward to 2016 and the sports supplement market is more competitive than ever across several platforms such as television, social media, print, billboards and expos.

More often than not, competition comes with some kind of controversy. The marketing techniques of these product types have come under scrutiny of late, with one sports supplement brand having been cleared recently by the Advertising Standards Authority of breaking advertising rules after complaints about a controversial marketing campaign. Protein World’s ‘Beach Body Ready’ campaign was cleared after nearly 400 complaints said that it objectified women by body-shaming, meanwhile also being labelled as ‘socially irresponsible’ by some. An online petition to remove the campaign’s posters gathered more than 70,000 signatures, while feminists defaced posters on London’s underground network.

Protein World’s beach body ready campaign ad Credit: Protein World

Despite the campaign’s integrity being questioned, the industry has continued to extend its reach with powerful and attractive marketing. With the digital world allowing companies to advertise in more ways than ever and word-of-mouth becoming a public forum, it seems these protein products are now a significant staple of the sports supplement industry online. Although this may be the case, the extensive and prevailing claims of certain UK sports supplement companies have been questioned recently in a bid to tackle controversial advertising that may not fit with EU law and guidelines. The authority tasked with regulating these claims are the ASA (Advertising Standards Authority).

“We take action to ban ad for sports supplements that make misleading claims. Our upheld rulings put on the public record where an advertiser has fallen foul of the rules.” ASA Press Officer Matt Wilson.

The Surrey-based company Protein World, also had its marketing techniques questioned earlier in 2015, not by the public or a competitor, but a Northampton Trading standards body – indicative of increased UK enforcement activity of the EU nutrition and health claims regulation (NHCR) which challenged whether the health and nutrition claims by the company were authorised on the EU Register. The company’s extensive claims on a variety of their products, including the popular ‘slender blend’, was brought to light after claims such as meal replacement, muscle building and metabolism were questioned. The nine-point action for multi-faceted marketing was upheld by the ASA in April 2015 with Protein World complying with all rulings.

“Protein World Ltd stated that the advertising claims had been amended since the complaint was received. They stated the website was a work in progress, which was updated as they expanded as a business, and would continue to be expanded. They stated that the product pages were to be redesigned.” (ASA Ruling)

The authority’s crackdown sits in line with increased UK enforcement activity of EU law, something that Press Officer Matt Wilson noted as an impact on the industry within the past decade. “The kinds of claims that advertisers can make and the evidence that we expect them to hold has been impacted by the Nutritional and Health Claims Regulations (EU legislation). In administering the Advertising Codes against ad claims for sports supplements we take into account and reflect the provisions set out in the NHCRs.”

Protein World are just one example of a company’s marketing in this field being challenged. Over in the US, MusclePharm, who were sued in a California federal court in January 2015, were challenged for the wording on their product’s labelling and branding. A handful of other companies were suggested to be ‘protein-spiking’ or ‘amino-spiking’ their products. The practice bulks out the content of the protein by using ‘fillers’ such as cheaper amino acids which show up as protein content during traditional nitrogen testing.

Claims on a variety of packaging outlined a number suggesting ‘complete protein content’ therefor leading consumers to believe they were purchasing that amount of whey protein when in fact, third-party tests, attached to some of the lawsuits, displayed a number of companies also included the far cheaper free-form amino acids such as glycine, taurine or leucine and then portrayed them as ‘grams of protein’ on the products’ labels. The message is clear, although certain amino acids are considered the building blocks to protein and have effective attributes, they are not protein by themselves, nor do they have the same benefits as complete proteins.

According to third party testing in one lawsuit, the company’s ‘Series Iron Mass’ contained half the protein stated on its label. The brand, fronted by Arnold Schwarzenegger on this particular line, denied the claims and stated they were doing nothing wrong. In regards to the activity, the FDA didn’t comment on the lawsuits but denounced the practice.

In contrast, it is apparent that the UK industry uses this practice in a more straightforward and regulated manner in regards to the labelling and branding. Packaging will, more often than not, outline the ingredients separately such as complete protein content from different sources and additional ingredients such as amino acids, with reasons for their inclusion. Although this may be the case, the labelling and advertising of whey protein products in the UK can still be questioned in regards to how it is portrayed to the public.

“FDA requires that dietary supplements be labelled in a manner that is truthful and not misleading. With regard to the labelling of protein content, FDA’s expectation for proper nutrition labelling is that firms will evaluate the protein content from actual protein sources—not other nitrogen-containing ingredients such as individual amino acids—and label the products consistent with the results of such evaluations.” Press Officer Jennifer Dooren, speaking to Forbes at the time.

Wilson reiterates that the authority works alongside and not against brands to assist their advert development, with consumers being at the heart of what they do. “We’re also committed to helping advertisers get their ads right. We monitor sectors behind the scenes; our compliance team contacts advertisers to pick up on potential problems and to work with them, bringing their ads into line.”

With more people using these protein powder products than ever, the questions become clear, are the brands developing their strategies to benefit the consumer and are they doing enough to educate their consumers about products and their attributes? Hamilton believes the market’s rapid evolution may not be beneficial to all. “The supplement market itself is huge and has certainly grown over the past 10 years. With this growth there will always be opportunists that want to make a quick buck, so we see some products on the shelves that have a lot of marketing behind them without there actually being much evidence to support the claims of the product.”

What is clear is that branding and advertising are both very powerful when a consumer enters a field of the unknown, particularly in this industry. The companies realise their mission and message is massively important when recruiting new consumers to the product, as well as converting the ones who already use it. Gym owner, personal trainer and supplement specialist Ewan Grewal highlights the fact that some products may not be more beneficial than others just because of their marketing. “There are some brands that are more well-known than others, some brands that are more well-represented than others, but that doesn’t necessarily mean it’s a better product.”

You could say Grewal has experienced a lot when it comes to protein powders; the marketing and understanding of the product while working in a supplement store, the importance of supplementation for his competitive clients and providing the products in his own local gym. This is a strong position to be in when choosing a protein powder, but not everyone has this experience and knowledge to fall back on.

With aspirations such as losing fat or putting on muscle, come psychological factors and feelings that are personal to the consumer. It is at this point where the branding of the product appeals to certain individuals and their specific goals. Cast back to the thoughts of the budding trainers from Plymouth earlier…

“I was training at school, I remember all these lads around me they were all bigger than me, and leaner, and I wanted to be like that. Without even thinking about it, I went on the internet and bought some whey protein without really knowing what it was, or the effects of it, or how it helped you.”

When one of us has made the decision to visit a shop, or jump on the internet to purchase a protein powder and enhance our training armoury, there’s many factors that come into play. It cannot be ignored that, more often than not, the marketing strategy of the product will play a part in some way.

It remains a mystery if the way the product was advertised was the decisive factor for this young man at the time, but his situation is just an example of product seeking to fulfil a personal aspiration, with the brands and their marketing strategies waiting in the wings. Meanwhile, Hamilton suggests there may be some confusion as to how consumers are interpreting the advertising and labelling of these products. “If someone comes to me with two choices, a ‘diet’ whey option and a regular whey, they often believe the diet option is ‘better’ for them even though the nutritional values may be exactly the same.”

It’s not to say that sports supplement brands aren’t looking to solve problems for their consumers by offering products that can have positive effects, in fact, the majority of these products will have some sort of science or proof that they work behind them to add to their appeal. But just how strong and valid is this claim-backing research? Again, Wilson believes the authority and brands are working together to combat misleading and unproven claims. “We haven’t seen evidence that advertisers of these products are deliberately creating misleading ads. We step in when an advertiser has made a claim that oversteps the mark and misleads either by exaggeration, ambiguity or omission. Ultimately, if an advertiser doesn’t have the robust evidence we’d expect them to hold in order to substantiate a claim, then we’re likely to find their ad misleading and therefore it will have to be removed.”

The perceptions of these whey protein products remain difficult to comprehend; whether the communication between the brand and consumer (about the product) is not clear enough, the lack of understanding from the consumer in regards to the product is not the brand’s burden, or the brands are influencing the use of products with excessive marketing. One person who sits on a tough perch is supplement store manager and fitness enthusiast Adam Brettell. “People just come in and think here’s a bunch of supplements, this is my magic pill and this is what’s going to help. I guess my job, from actually selling the products, is to de-myth that, to make sure they are buying the product, knowing the results and what kind of outcome they can get,” he said.

'Behind the counter'

In this situation you could call Brettell a middle man, taking information from a variety of brands and breaking it down to consumers in different scenarios to advise and educate – similar to many other industries. Although it’s clear his intentions are to benefit the consumer and meet their needs, the marketing and advertising of the company may influence the communication between Adam and the consumer. If Brettell is constantly being fed a vast array of information from above, it’s likely that the brands intentions are filtering through the resulting conversations with consumers – a knock-on effect.

What can be said is that having someone like Brettell to break down this information is a key bonus of purchasing products on the high street compared to online. The internet can be a lonely place when searching for products to match personal aspirations, with an information overload to add to it.

The intentions of the brand may be to educate and advise the consumer, while searching for products online before purchase, but it seems this may not be the priority with carefully advanced advertising techniques more often than not outweighing the suitability of the product to the consumer. In simple terms, we end up buying products we don’t need or ones that just sound promising from a giant aspirational database.

With the market growing rapidly and consumer needs evolving, other avenues have come to light for sports supplement brands to branch into and make their mark with campaigns and adverts. A continually expanding area of the sports supplement market; female-targeted protein shakes that aim to assist specific goals that women are particularly interested in pursuing, such as weight loss.

It is noticeable that the majority of these female-targeted products have gender friendly ingredients, but it can be noted that the advertising and marketing influences the target consumer demographic, in this case women. “Ingredients such as CLA, Green tea extract and that type of marketing seems to appeal to the female market more as they associate these things with a softer ‘health’ image,” says Hamilton.

“It’s probably safe to say that the size of the market has increased exponentially over the last decade. That’s resulted in a significant increase in the amount of advertising for these products.” ASA’s Matt Wilson.

Although these specific products may be meeting the needs of some consumers, the problem for others seems to be the communication breakdown between brand and consumer about the product. Bikini physique competitor and sports therapist Tori Coltart believes products can often be categorised in the wrong way, “there isn’t any different between male and female protein at all.”

What we can gather from this is that some of the claims are difficult to put into context and sometimes largely unmeasurable. Although scientific evidence of external studies on specific individuals may support a claim, many variables will change within a consumer’s lifestyle that can affect the outcome and results for themselves. It is evident that neither the brands nor consumer are at fault for these ongoing scenarios regarding the resulting effectiveness of the product, but what can be highlighted is the powerful and influential marketing used in combination with existing scientific proof to stimulate consumer interest, based on aspirations.

“There’s not that many female role models”

It is here where trust plays a key role between the brand and consumer, as to whether the individual product marketing strategies are exhibited with honesty and integrity. In reference to the regulation of this conduct, Wilson reiterated the ASA’s confidence in reassuring a fair and honest sports supplement market. He said, “our role is to ensure that consumers can trust the ads they see and hear and to help establish a level playing field amongst business.”

The ASA will continue to regulate and maintain the market where it can, clamping down on the hard and misleading health and nutritional claims of these companies, but the soft claims (theories that cannot necessarily be proven in scientific context) and perceptions of the public will seemingly continue to alter depending on trends within social commerce and the public mainstream.

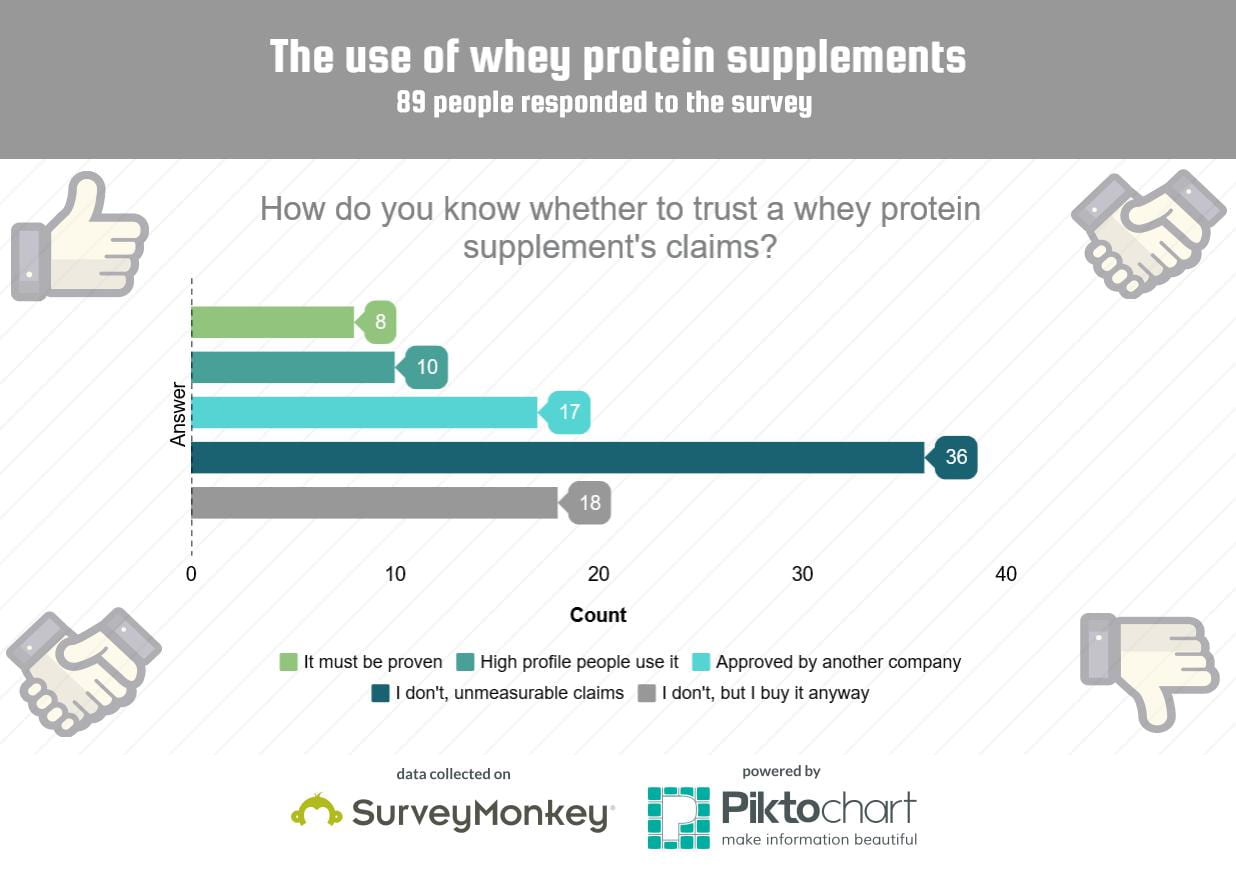

The majority from the same online survey are undecided on whether to trust the statements of these brands

Over 40% of respondents to the survey don’t know whether to trust a sports supplement’s claims, in particularly some of the ‘unmeasurable claims’, signalling a feeling of scepticism. Undoubtedly it cannot be generalised, but there is a clear indication that some consumers feel the product’s claims can be misleading or questionable, something the ASA is eager to eradicate.

The advice is somewhat similar to putting your car in an unknown garage or simply reading elements of the internet, do some homework before diving in and don’t believe everything you see at a first glance. In regards to whether the information provided during advertising and branding is completely helpful, and how to distinguish the right products for you, Hamilton suggests doing some investigating beforehand, “I think companies are getting better at putting this information out there, however I would always be sceptical and do research from more than one source before purchasing.”

And if you do purchase, it’s probably best not to follow Arnie’s lead and top up your shake with Jack Daniel’s or Jim Beam.

Be First to Comment